Embezzlement is the fraudulent conversion of property or money entrusted to one’s care. While there are many ways embezzlement can occur, the most common scenario involves a business owner or person responsible for running a business purchases goods or services from an outside supplier. Due to either an error in judgement or policy, the supplier does not pay fair market value for their product or service.

This can happen legally – if a customer does not receive their payment in full, the business has lost their ability to claim money from the supplier. Alternatively, it can happen in a non-legal way – if a supplier does not send what was agreed upon, then there is no way to claim what was owed them.

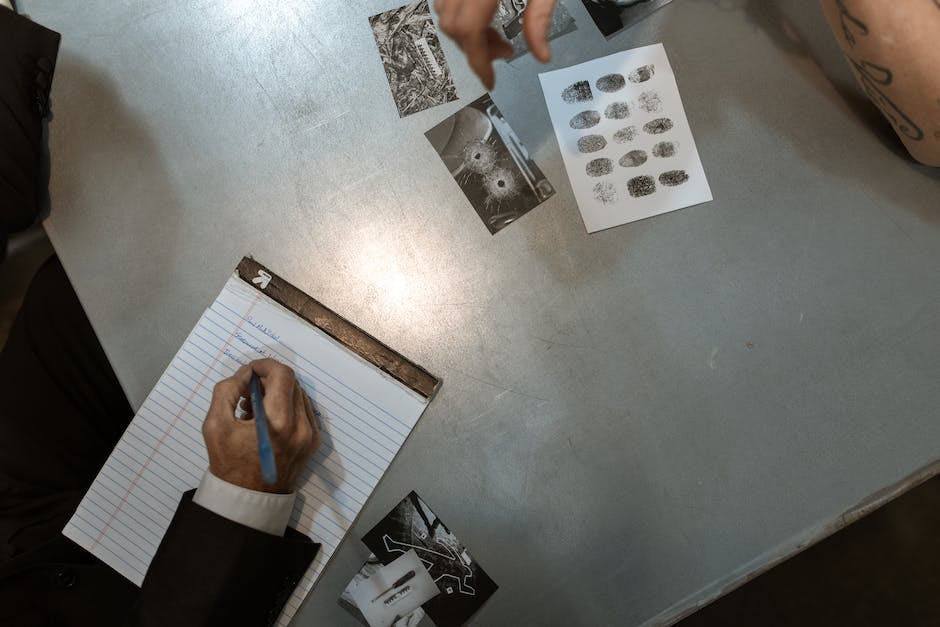

This article will talk about ways to prove embezzlement against a company that runs with no physical evidence.

Contents:

The amount stolen

Most embezzlement cases do not cost much at all. Most people do not realize that at the end of the day, your stolen money is costing you.

Embezzlement is a very expensive crime to commit. Statistic show that around 50% of the total amount stolen is returned to the person rightful owner. This means that the person was completely out of money and had to borrow or steal the rest for things.

It is important to note that when a company embezzles, they need to repair their mental health before they can repair their bank account. It is important to get help soon after this as it can cause major problems with finances.

Proper steps can be taken once again when this happens.

The financial state of the company

As mentioned earlier, it is important to determine how well the company is doing. This can help prove embezzlement against a company because of a negative cash flow.

A large indicator of a company’s financial health is their stock price. When the stock price is going down in value, it shows that something is not right.

Investors can use hard evidence to prove embezzlement against a company. Some examples of evidence that investors provide proof of embezzlement against companies include: out-of-pocket expenses, missing records, fraud alerts, and missing records.

In order for proof of embezzled funds to be accepted, the evidence needed to prove it must be hidden or concealed. This could be hiding records in a safe or hiding money in an account.

Any inconsistencies or unexplained expenses

It is important to know what evidence is not needed in order to make it easier to prove embezzlement.

Some evidence is considered unnecessary because it does not support the claim of embezzlement. For example, funds spent on a personal laptop rather than a computer at work may be necessary for this evidence.

Other evidence that does not support the claim of embezzlement includes odd bills or charges, unexplained investments, and unexplained deposits.

It may be necessary to contact regulators and authorities in order to determine if embezzled funds have been returned, but beyond that, medical care and legal matters, there are no further matters that need to be taken care of.

In order for authorities to conclude if embezzlement has occurred or not, they must find proof of money being spent versus money being taken. Without this, there is no proof of fraud.

Look for abnormal cash flow

Another key sign-of-embezzlement is a lack of cash flow. If someone is stealing money from you, then they should be paying bills and making investments to prove they are spending their money.

This can be difficult to spot, as it is easy to spend money without immediately thinking about how much you spent or who paid him. Most people don’t realize how much they spend until they see their bank statement or check.

If someone is paying out large sums of money, look for a reason. Maybe they are buying a car or another piece of expensive equipment?

Do not assume that because someone spends large amounts of money that they are spending it on you. People can easily get carried away with their lifestyle and start believing they are the main person responsible for paying them.

Vulnerable Situations Involving Embezzlement

Embezzlement occurs in all types of businesses, including nonfinancial ones. Here are some tips to help prevent this crime:

1knowyourcompulstioneargetintoituitinga liabililizationagreement(LAA).A LAA provides legal protection for an individual against assets owned by another party to the agreement, including fraudulently obtained funds.

Talk to the victim about their finances

If the embezzler is very well-off, contact a charity or organization that helps the poor. Investigate if you think they were stolen from.

Many crimes are disguised as aid or charity funding. Therefore, it can be hard to tell the difference between an aid donation and money donated for personal use.

If you find evidence of fraud, contact law enforcement authorities immediately. They can help you recover your money!

The number one reason people embezzle is to buy food. Most people eat too cheap to purchase expensive foods and drinks which are low in sugar and fat free. This makes it difficult to determine if someone is using the food or just eating it because they do not want to buy much else.

Ask the victim for documentation

If a victim requests a piece of documentation from the embezzler, you should be careful. This could be evidence of fraud or extortion, so ask for a copy of the bank account statement, receipts, and the victim’s ID to verify.

As a last step, compare this information with the documentation the embezzler has provided to show identity and embezzlement. If anything looks fishy, contact authorities immediately!

The best way to prevent this type of fraud is to ask for legitimate documentation from authorities and not least because it will protect you in case the embezzler goes missing.

Review financial records

It is recommended that you review any financial records or records of purchases that include money for immediately. This can help prove if someone embezzled money or not.

It is important to note that the financial records should be in a safe place. Perhaps stored in an account or bank account, or kept as bank statements and credit card payments are typically kept.

It is also important to note that the person responsible for embezzling should not have been spending very much money, because if it was cheap or easy to hide, then noone would have noticed it.

Compare current balance to previous balance sheet

When a company has a large cash-on-hand, it can create evidence of previous balances. This can help prove embezzlement as the balance sheet does not change much over time due to this excess cash on hand.

If a company has been in default of past payments, it can show up the current balance sheet as they do not receive money from previous payments. This may help prove fraud as there is no proof of an ongoing business income source.

A common example is real estate transactions where a company purchases a property and transfers money between accounts to cover expenses such as construction and listing fees. When one party sells the property, they may receive more money than what was originally invested in order to cover expenses.

Neither party reports this however as an addition asset value is required in order for the current transaction to match the previous one. This way, evidence of past business deals is needed.